In April 2008, the Paraguayan Associación Nacional Republicana (ANR), locally known as the Colorado Party, was defeated in the presidential election by a coalition of opposition parties and social organizations led by a former Catholic bishop, Fernando Lugo. This was a dramatic and largely unanticipated change in a country in which the Colorado Party had enjoyed a monopoly in political power for 61 years, including the 35 years of the Stroessner dictatorship (1954-1989) and the 19 years elapsed since the 1989 coup. For six decades, the Colorado Party had systematically channeled public resources to a subset of citizens by distributing public employment and procurement contracts to the benefit of party members and supporters of the regime.

As in other countries where the rule of a single party lasts for such a long time, the incoming government faced challenges of a different nature and magnitude than those of countries accustomed to regular democratic shifts in power. The distortions in the structure of incentives, the weight of political patronage and corruption in all aspects of economic life, and the institutional shortcomings that characterized the regime were so profound that it was obvious from the start that transforming the Paraguayan economy, one of the least developed in Latin America, would be a daunting task.

In Straub (2014), I document a specific aspect of this transition, namely, the changes in the relevance of political connections for the allocation of public funds through procurement spending, and analyzes the impact on the efficiency of public procurement spending after democratization using a unique dataset that tracks nearly all public procurement contracts in the country, representing around 10% of the country's annual gross domestic product (GDP), from 2004 to 2011.

Since the seminal work of Roberts (1990) in political science, and Fisman (2001) in economics, a large number of contributions have documented the importance of firms’ political connections, understood to stem from family ties, friendship, party membership, or campaign contribution, for firms’ performance measured by their stock market valuation, or specific economic inputs that firms secure, including credit, favorable regulatory outcomes, and public procurement contracts among others.

Here, I use a unique sample that tracks 700 firms, covering 70% of the country's public procurement spending, and rely both on an objective measure of connectedness, namely party membership, and a concrete outcome in the form of access to procurement contracts. Moreover, by comparing periods before and after a major political change, I illustrate both the potential economic benefits of democratization in long-term single-party authoritarian regimes, and the economic costs stemming from the long-lasting perverse entrepreneurial incentives that derive from an economic organization based on political connections.

The database used in this study contains nearly all the procurement transactions (101,083 contracts) made from 2004 through 2011 between 59 public institutions and 9,193 firms. Total public spending represents between 5.5% and 10.7% of Paraguay's annual GDP over the period. Moreover, using data on boards of directors from the local credit bureau, cross-checking against the listings of the two main political parties, and completing through extensive consultations with persons knowledgeable of the political environment, a second dataset tracking the political connection of the largest 695 private Paraguayan firms was developed.

It was necessary to distinguish between two levels of political affiliation with the ANR. `Rank and file' (ANR rank) affiliates are formal members, though not influential. They are likely to belong to the party mostly for opportunistic reasons, such as obtaining the right to operate or avoiding extortion. `Hierarchs,' (ANR core) on the other hand, are, directly or through their close family, influential members or have occupied important administrative functions and are connected to the top levels of government. Of the 695 firms included, 526 have some political connection (455 to the ANR, 50 to the PLRA, 21 to other parties), showing the ubiquity of political connections in the Paraguayan context. Of the 455 ANR-connected firms, one third belongs to ‘core’ ANR members.

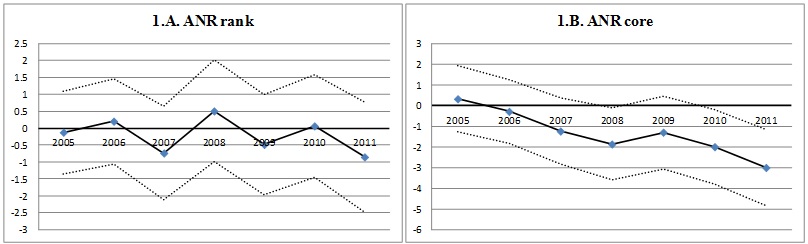

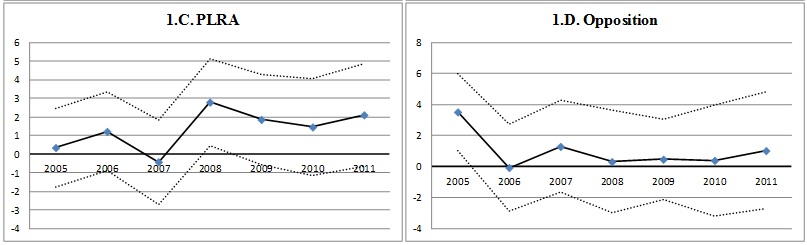

As shown in Figure 1, which tracks the volume of public contracts received by firms with different political ties, after 2008 those connected to the previous regime were "punished," especially firms belonging to former influential Colorado `core' members connected to the top levels of government (ANR core). Conversely, firms connected to the main party of the opposition coalition (PLRA) benefited in the initial period of the new government but, overall, non-connected firms were the main beneficiaries of the losses incurred by connected entrepreneurs.

Figure 1: Year-by-year interaction coefficients of the change in amounts of contracts by type of connections

Moreover, I also find that during and after the transition, both ANR core and rank firms experienced a reduction in their portfolio in big categories (those with a turnover of purchase above the median before 2008), while partially compensating for this in smaller categories. These results are consistent with a scenario in which, in the pre-2008 situation, connected entrepreneurs were coping procurement contracts in smaller categories, while larger categories were more open to other non-connected firms. As these connected entrepreneurs were winning contracts not on the basis of being more competitive, but through political favor, they were more likely to be outplayed after 2008 in categories where competition was restored, especially if the volume of procurement grew rapidly. On the other hand, in product categories that had historically excluded non-connected firms, connected firms were able to take advantage of incumbency to improve their position after 2008.

The fact that ANR rank entrepreneurs struggled to maintain their position when faced with more open competition after 2008 indicates that they were less efficient to start with and were only in business thanks to their political connections. In that sense, political favoritism affected the composition of the entrepreneurial class well beyond the first circle of connected core ANR entrepreneurs.

Finally, I question whether substituting politically connected and thus potentially less efficient firms for non-connected firms might have been efficiency improving. I aggregate the full dataset so as to track the effect of changes in the amount of contracts awarded to politically connected firms at the institution-year level. Following Duflo (2001), I use the previous results to instrument the evolution of the amount of these contracts with the political break that occurred in 2008, interacted with specific characteristics of the institutions (see Straub, 2014, for the technical details).

The results show that a reduction in the log amount of contracts to political firms implies a reduction in the number of firms with which an institution contracted after 2008, an increase in the share of competitive contracts in general and, more specifically, in the type of tendering arising for contracts of a size just above the threshold between direct contracting and small tenders.

In a context of abrupt political change, the fact that entrepreneurs closely connected to the previous regime were punished and their share of public procurement reduced was not directly balanced by the entry of new entrepreneurs, either connected to the new regime or with no connections, as witnessed by the reduction in the average number of firms. A possible explanation is the absence of such entrepreneurs in the short to medium term, as the long-lasting grip of the Colorado regime discouraged entrepreneurship by opposition members. On the other hand, it is also possible that procurement contracts were previously inefficiently divided between too many firms.

When splitting the sample of contracts between the product categories with a cumulated number of suppliers above or below the median in the early 2004-2007 period, I show that the efficiency results hold only for categories with many suppliers to start with. For these, a decrease in political contracts translated into a significant decrease in the number of suppliers, a significant increases in the concentration of purchases, in the share of contracts made through a competitive call for offers, and a shift toward a mix of firms with a lesser history of previous bank incidents registered in the local credit bureau, which can be interpreted as an indicator of better quality providers. The marginal effects are large. Comparing the 25th and the 75th institution-year percentile in terms of the amount of contracts to connected firms yields a 25% reduction in the number of suppliers, an increase in the share of competitive tenders from 6.8% to 23.4%, and a reduction in the share of providers with a history of bank incidents from 15.7% to 10.6%.

Conclusion

After 2008, the decline in political contracts translated into public institutions using bigger contracts under competitive mechanisms and contracting with fewer and more efficient firms. While some efficiency gains appeared in this process, there was also evidence of binding constraints stemming from the decade-long monopolization of power of the Colorado regime and related to the time needed for an efficient class of new entrepreneurs to emerge.

These results thus shed light on how, following democratization, the characteristics of the Paraguayan long-term authoritarian dominant-party regime made it difficult to transition out of the development trap created by widespread rent-seeking entrepreneurship. The inherited non-existence of a strong independent private sector led to a lack of room to maneuver for the new government and, together with the other policy constraints, eventually contributed to the government's fall through a parliamentary coup in 2012.

This article is taken from the personal blog of Stephane : http://www.stephanestraub.com/