Covid-19 has accelerated the transition to a new age of digital progress, creating opportunities for the widespread and rapid adoption of both new and established platforms. Overall, although with important distinctions, ‘Big Tech’ (the dominant companies in the information technology sector) and digital firms more generally have been coping better than the rest of the economy with this unprecedented crisis, both in the short and medium run.

Many of these businesses have also been instrumental in supporting most people’s safe access to goods and services, which has increased the pace of digital transformation. But not all platforms and digital firms have reacted in the same way, and some of them may be on the brink of failure.

How have the internet giants coped with the crisis?

The stock market provides some insights into the information technology sector. Despite some known limitations, changes in share prices make it possible to survey how different industries have been affected by Covid-19 almost in real time (Griffith et al, 2020).

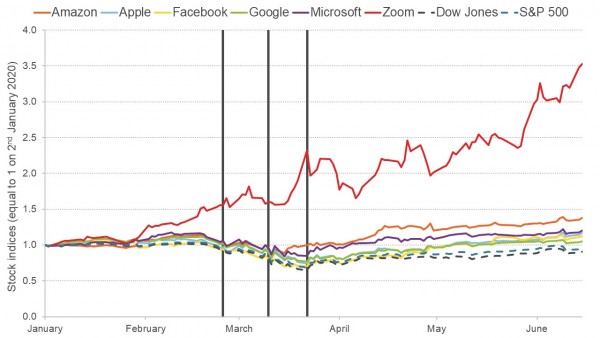

Figure 1 focuses on the share prices of the five internet giants – Google, Amazon, Facebook, Apple and Microsoft (GAFAM) – and Zoom. A comparison with the wider market is provided by two of the leading stock market indices, the values of which are normalised to 1 at the beginning of January 2020.

The Dow Jones Industrial Average (DJIA) tracks the share prices of 30 of the biggest US companies, and the Standard & Poor's 500 Index (S&P 500) tracks 500 large-cap US companies. Both provide a big picture view of the state of the stock market as a whole. Importantly, the companies tracked are traded in New York, just like GAFAM.

Figure 1 indicates that the share prices of GAFAM crashed almost as heavily as the rest of the stock market at the beginning of the pandemic (in late February and early March). But the recovery of these companies has been faster and stronger. In particular, by May 2020, GAFAM had bounced back to their start of the year values, whereas by mid-June, both DJIA and S&P 500 companies were still below theirs.

Overall, the internet giants have recovered faster and more decisively than the stock market as a whole, suggesting the greater resilience of the sector compared with the rest of the economy. While the resilience of digital firms is certainly positive news, concerns may arise if it is accompanied with more concentration and market power, as recent antitrust investigations in the European Union and United States seem to suggest.

Figure 1: The stock market since January 2020: GAFAM and Zoom vis-à-vis the market indices

Note: Vertical lines represent (i) 26/2 – first US Covid-19 death; (ii) 11/3 – the World Health Organization declares pandemic outbreak; (iii) 23/3 – the UK declares lockdown.

Whereas all GAFAM share prices suffered in the short run, the heterogeneity of the impact of the crisis is also apparent from Figure 1. As most spending shifted online, e-commerce platforms were able to recover and eventually to gain. In particular, Amazon’s share price plunged right after the implementation of the first drastic measures in Europe in early March, but quickly recovered its value by the end of that month.

This was driven by the large and sudden shift towards online spending during lockdown, which also affected the patterns of household consumption between different types of goods and services (Relihan et al, 2020). By June 2020, Amazon’s share price was worth approximately 40% more than in January.

Not all companies experienced the same pattern. Internet giants that rely heavily on revenues from advertising, such as Google and Facebook, had to wait until May for their market values to match their January levels.

One possible explanation may lie in the pessimistic expectations generated by lockdown on future consumption, which may have led corporate marketing departments to reduce advertising expenditure abruptly. Apple’s share price may have been further hurt by a possible substitution of high-end products as a result of the expected post-Covid-19 economic crisis. These initial expectations might have been adjusted following the quick switch of many activities to digital alternatives.

Who is the real winner? The Zoom boom

In Figure 1, there is a clear outlier. During lockdown, as many people worked from home, most meetings and events were held online. It was not only business activities, but also academic seminars, conferences and teaching at all levels – and everyone socialised, sang and celebrated birthdays… all online. Microsoft Teams, Skype, Google Meet, Cisco WebEx and, above all, the kingmaker of video conferences, Zoom – an almost ten-year-old platform – benefited from an unexpected boost in their adoption.

Figure 1 shows that Zoom’s market value has more than tripled during the crisis. As a comparison, its main competitor in the video conferencing ecosystem – Microsoft, which is one of the firms that has coped better with the crisis – gained only 15% compared with its January market value. Both companies were up to the task, and reaped some of the opportunities that the crisis has generated (as also illustrated by Abay et al, 2020, who focus on Google queries during the pandemic).

Which platforms suffered the most?

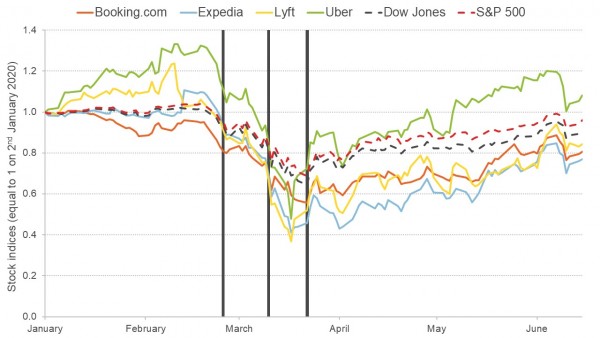

Not all digital firms responded so well to the challenges posed by Covid-19, even in the medium run. The transport and hospitality sectors have been severely affected by the crisis, and platforms working in those sectors were also hit badly.

Compared with traditional hotel chains, which are still struggling to reach full capacity (see, for example, CNN.com and Reuters), platforms in the hospitality sector are not facing the same problem. But market uncertainty in the hotel sector is still reflected on these platforms.

Figure 2 shows that the share prices of Booking.com, Expedia, Uber and Lyft all plunged at the beginning of March, when the first drastic measures were adopted in Europe, and reached their minimum levels (at almost 40% of their January market values) in late March.

With all the due caution related to the presence of other factors (for example, the Federal Reserve’s quantitative easing), their recent stock market performance seems to suggest a slight recovery of the tech companies most adversely affected by the crisis.

Uber is the only company performing better than the indices, and it is getting back on track faster than its competitor Lyft. This may be related to the conglomerate nature of the company, which is active in the food delivery sector, with Uber Eats experiencing a boost during lockdown (Raj et al, 2020). In the hospitality sector, share prices have recovered, at most, up to 80% of their January value, with Booking.com doing only slightly better than its main rival Expedia.

Figure 2: The stock market since January 2020: share prices of hospitality and transport platforms vis-à-vis the stock market indices

Note: Vertical lines represent (i) 26/2 – first US Covid-19 death; (ii) 11/3 – the World Health Organization declares pandemic outbreak; (iii) 23/3 – the UK declares lockdown.

Will these changes be durable?

Zoom benefited mostly from its simple and light interface and by the shift towards remote working. Network externalities – which typically worry many economists because of potential barriers to entry – were not very strong, and this helped the platform to succeed. This is in line with the view that network effects are weaker for digital services than for hardware (Tucker, 2019).

A natural question is whether there is a ‘new normal’ and if some of the drastic changes we have experienced in our lives are likely to be permanent. Remote working has both benefits and costs.

On the positive side, it reduces commuting times. The unproductive time spent in traffic – up to 178 hours per year for UK drivers according to INRIX – can be saved and employed in other activities, with possible benefits for work-life balance and mental health. Likewise, it fosters a type of work based on results and so determining more flexibility in individual time allocation.

On the other side, online work may induce overwork, reduce networking opportunities and the sense of belonging to a community, therefore affecting the personal dimension associated with working activity.

In addition, apart from the lack of sensory experience that online interaction generates, many have found it difficult to concentrate and are now experiencing ‘Zoom fatigue’. The absence of childcare facilities, as well as uneven allocation of household and childcare responsibilities, can widen the gender gap (Alon et al, 2020).

Related question: How has coronavirus affected the division of domestic labour?

How could Covid-19 change the future of many professions?

As noted by many scholars, not all work or professions can be performed remotely (Dingel and Neiman, 2020). During the pandemic, young workers have been more likely to work from home (Brynjolfsson et al, 2020) while minorities and workers without a college degree have been among those less likely to work remotely (Mongey et al, 2020).

It is therefore reasonable to believe that depending on the type of activity, there is an optimal allocation of time to be spent at home and in the office. Many firms in sectors where remote working does not lower productivity are planning to adopt a blended model for the foreseeable future. This could imply significant savings in terms of physical space and related aspects of on-site work (food and beverage provision, parking lots, transport cost refunds, etc.).

Such a blended model is also likely to characterise future academic life, with in-person activities integrated and complemented by online ones. In the case of seminars, such a strategy may potentially combine the benefits of personal networking with unprecedented access to resources and presentations all over the world.

In the professional sector, most activities are likely to become blended as well. In the healthcare system, according to The Lancet, the pandemic has generated the conditions for a big transformation, with a ten-fold increase in the number of virtual patient consultations in the United States. It is therefore reasonable to expect that virtualised healthcare is here to stay, with most unnecessary physical meetings converting into online ones, eventually supported by the development of artificial intelligence in the sector.

How to sustain these digital changes?

Massive economic support programmes through monetary and fiscal stimulus have been implemented across the world since the beginning of the Covid-19 emergency. If governments decide to use most of this money for unemployment benefits and short-term relief for those categories of people who were hit hardest by the crisis, then a digital transformation will not be completed.

But there are some encouraging signs that this will not be the case. Many countries are investing heavily in digitalisation, and may soon become the lighthouse in the Covid-19 storm. China, for example, is outspending other countries in terms of 5G infrastructures. This will be useful not only in supporting the digital activities of the portion of the population that was confined at home for so long, but also in terms of supporting health applications that reduce the spread of the contagion.

In terms of network speed, 5G tops out at 10 gigabits per second, and it is said to perform from 10 to 100 faster times than 4G. This is crucial if we want the digital transformation to accelerate. For consumers, this means not just faster mobile internet, but mainly enormous and reliable internet connectivity, which will be a necessity if a blended model of working life (and unfortunately also social life) is to characterise our near future.

Authors: Carlo Reggiani (Manchester), Leonardo Madio (TSE) and Andrea Mantovani (University of Bologna)

Copyright: Economics Observatory